OVER ARCHING BAND WEALTH STRATEGY

Focus is on scalability and high-return assets. Risk tolerance is much higher.

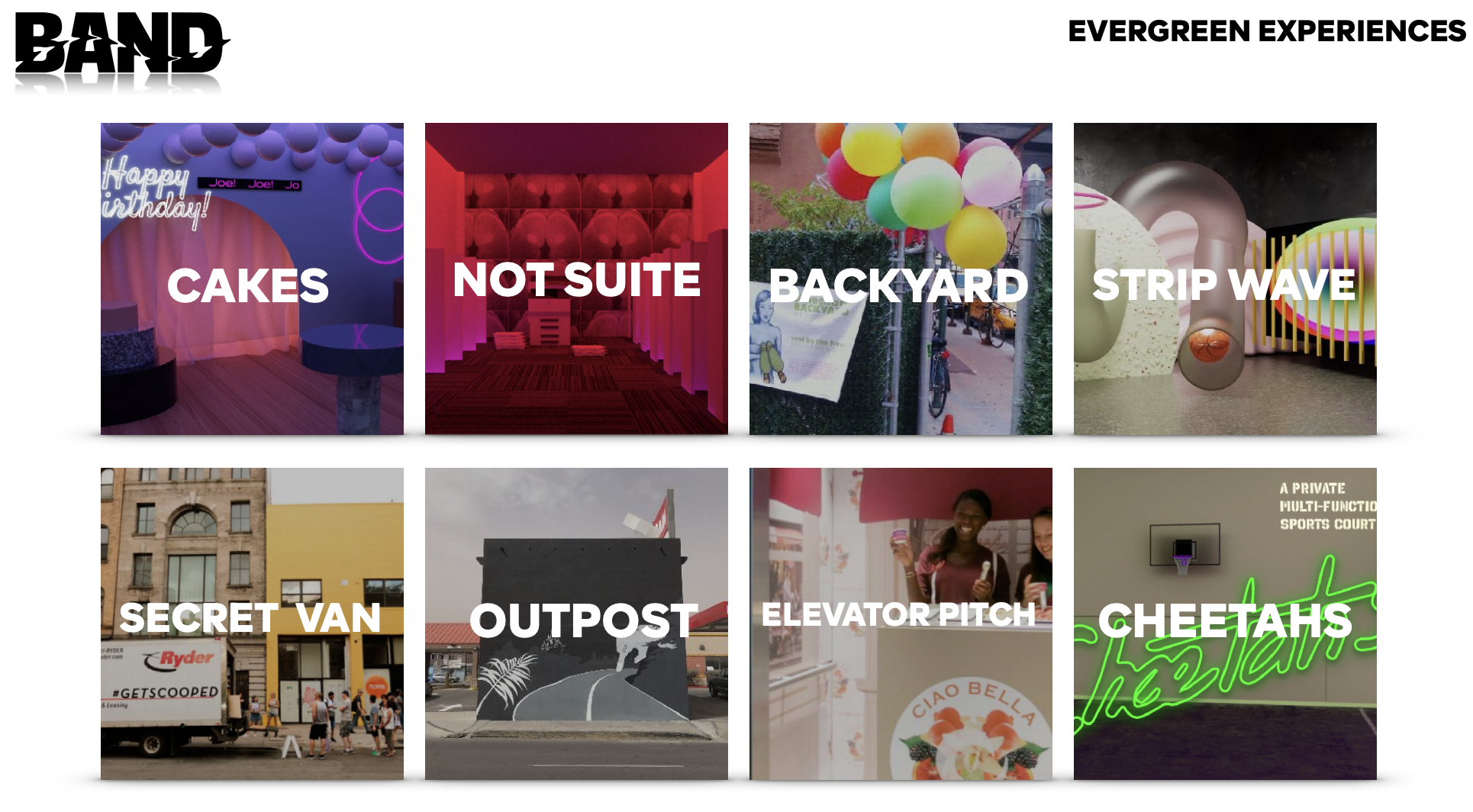

OWN BUSINESSES

BANDANA STAFFING

BANDKITS

BANDITS STAFFING

PRIVATE EVENT SPACE - HOUSE BAND- test ground for Cakes, Other models

PRODUCTS - EASY SPACE ENHANCERS - conscentric, etc

COMMERCIAL + RENTAL REAL ESTATE

STR TO USE TAX LOOPHOLE

COMMERCIAL PROPERTY WE OWN

REAL ESTATE FUNDS INVESTMENTS

EQUITY INVESTMENTS

CRYPTO

PUBLIC STOCKS

STARTUPS IF WE HAVE PROPER DEAL FLOW

Venture capital & private equity access

TOOLS

LEVERAGE - ESPECIALLY FROM CHASE

TAX STRATEGIES

STR LOOP HOOLES

LLCS/SCORPS

1031 EXCHANGES

COST SEG + BONUS DEPRECIATION

QSBS

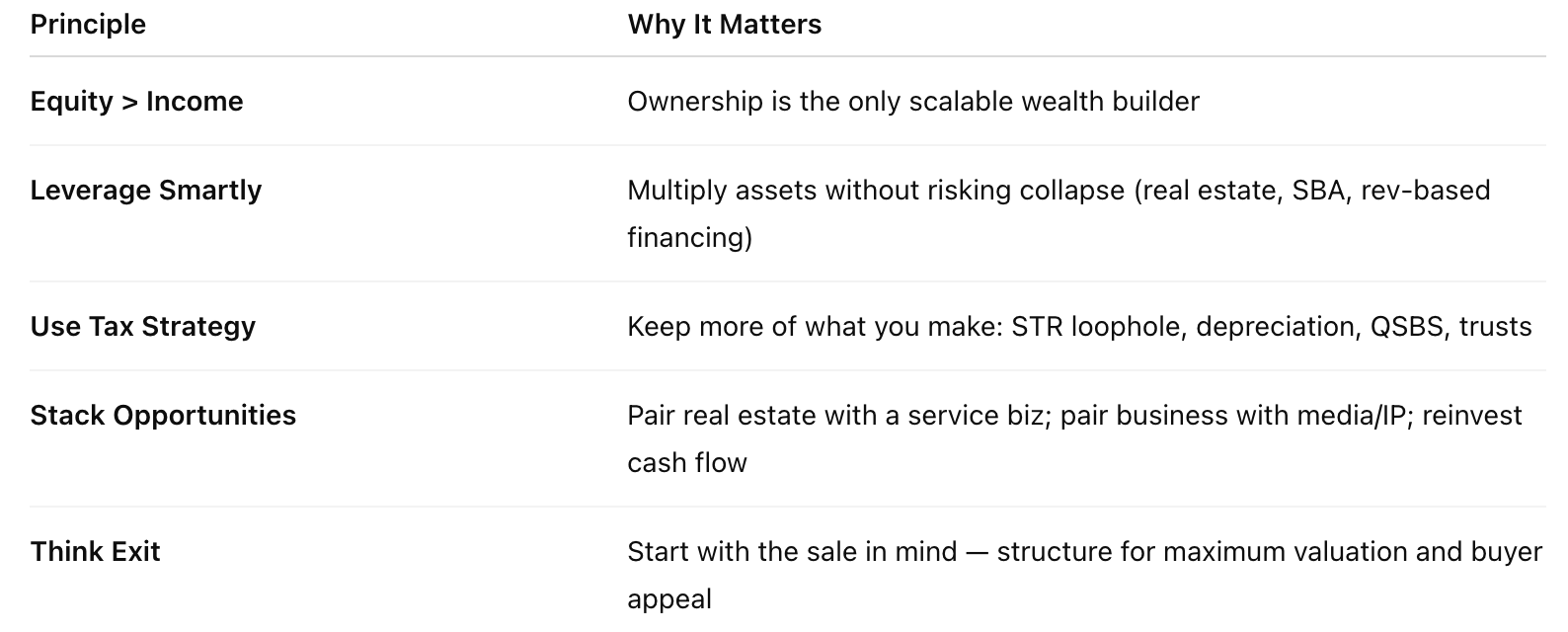

🧠 Key Principles to Get There Fast

Using ownership, leverage, and tax strategy to multiply OUR capital — not just protect it.

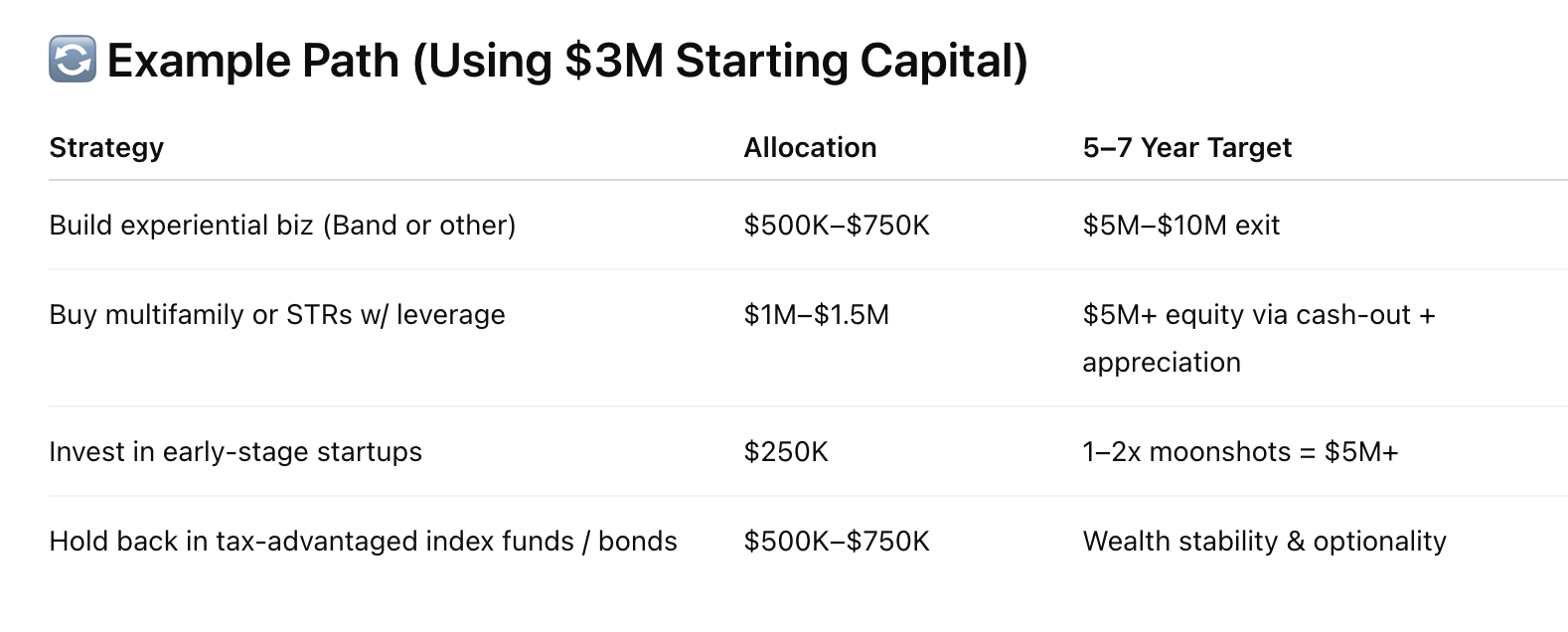

🚀 Tier 1: Fastest Paths to $10M+ (High-Return, High-Control)

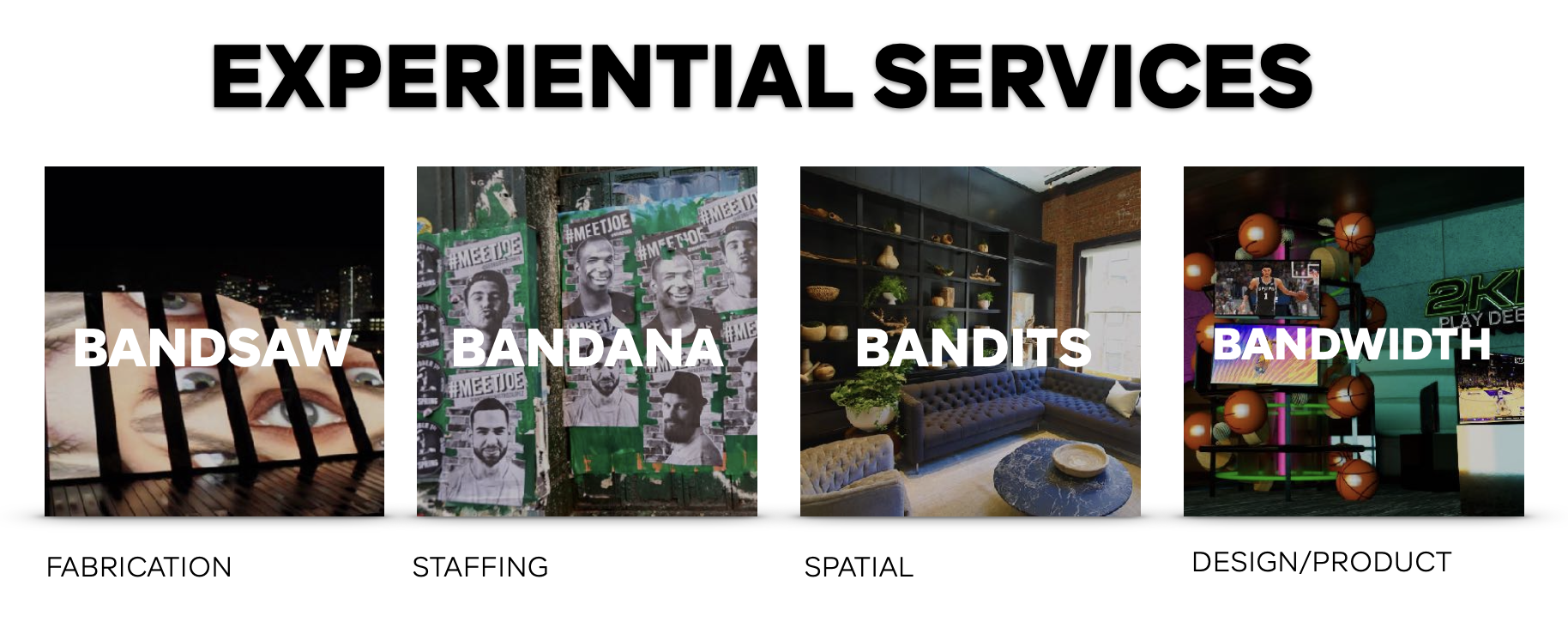

1. Build & Scale a High-Margin Business

Why it works: We keep the upside, build equity, and can exit for 5–10x earnings.

Target: We build Bandits + Kits

Hire fast, scale using systems, build recurring revenue

Sell or recapitalize within 3–7 years

✅ Can turn $500K–$1M into $10M+

📈 Most self-made ultra-wealthy did this

⚠️ Requires operational skill & grind

2. Real Estate with Tax Acceleration + Leverage

Why it works: We earn cash flow, tax write-offs, and appreciation — all multiplied by debt.

Strategy: Buy $10M+ in multifamily or STRs using $1M–$1.5M down

Use cost segregation + bonus depreciation

Refi, cash-out, roll into larger assets (BRRRR + 1031)

✅ Control asset, cash flow, reduce taxes

⚠️ Location and ops matter; STR loophole = gold if active

3. Buy and Grow a Business (SMB Acquisition)

Why it works: You skip the startup risk and scale an existing cash-flowing asset.

Target: $2–5M in revenue, $500K–$1M EBITDA

Use SBA loan + $500K–$1M equity injection

Grow through ops, marketing, pricing

✅ Faster than startup; path to $10M exit

⚠️ Needs ops leadership or GM team

YEARS 1 - 3

💼 Tier 2: Capital Multipliers (Medium Return, Low Effort)

4. Angel or Early-Stage VC Investing

Why it works: One 50–100x outcome can return $10M+ on a $250K portfolio.

Write $25K–$100K checks into 10–20 startups

Join syndicates (AngelList, private deals)

Invest in industries you know

✅ Best returns possible, passive if well-networked

⚠️ High risk, long timelines (5–10 yrs)

5. Private Equity & Debt Lending

Why it works: Equity-like returns with downside protection if structured well.

Lend to real estate operators, acquire notes

Invest in revenue-based financing or asset-backed lending

IRRs of 15–25% common

✅ Income + protection + compounding

⚠️ Need strong deal vetting and legal structure

YEARS 3 - 5

🧮 Tier 3: Foundation Builders (Safe, Tax-Efficient)

6. Asset Allocation with Tax-Advantaged Growth

Why it works: Keeps your wealth compounding while you take bets elsewhere.

Backstop: 40–60% of wealth in stocks, tax-free growth (e.g., Roth, life insurance, Opportunity Zones)

Long-term tax minimization (charitable trusts, loss harvesting)

✅ Keeps taxes low, avoids erosion

⚠️ Doesn’t build wealth alone — it's protection